How A Car Insurance Deductible Works

Doug Stockman • April 24, 2025

This is a subtitle for your new post

TL;DR - Quick Take Away:

Car insurance deductible = the amount you pay before insurance kicks in. Low deductible = pay less upfront, higher monthly premiums. High deductible = pay more upfront, lower monthly premiums. It helps avoid small claims, keeps you invested, and offers choices. Pick the right one by considering your budget, driving, and car value. We're here to help you figure it out!

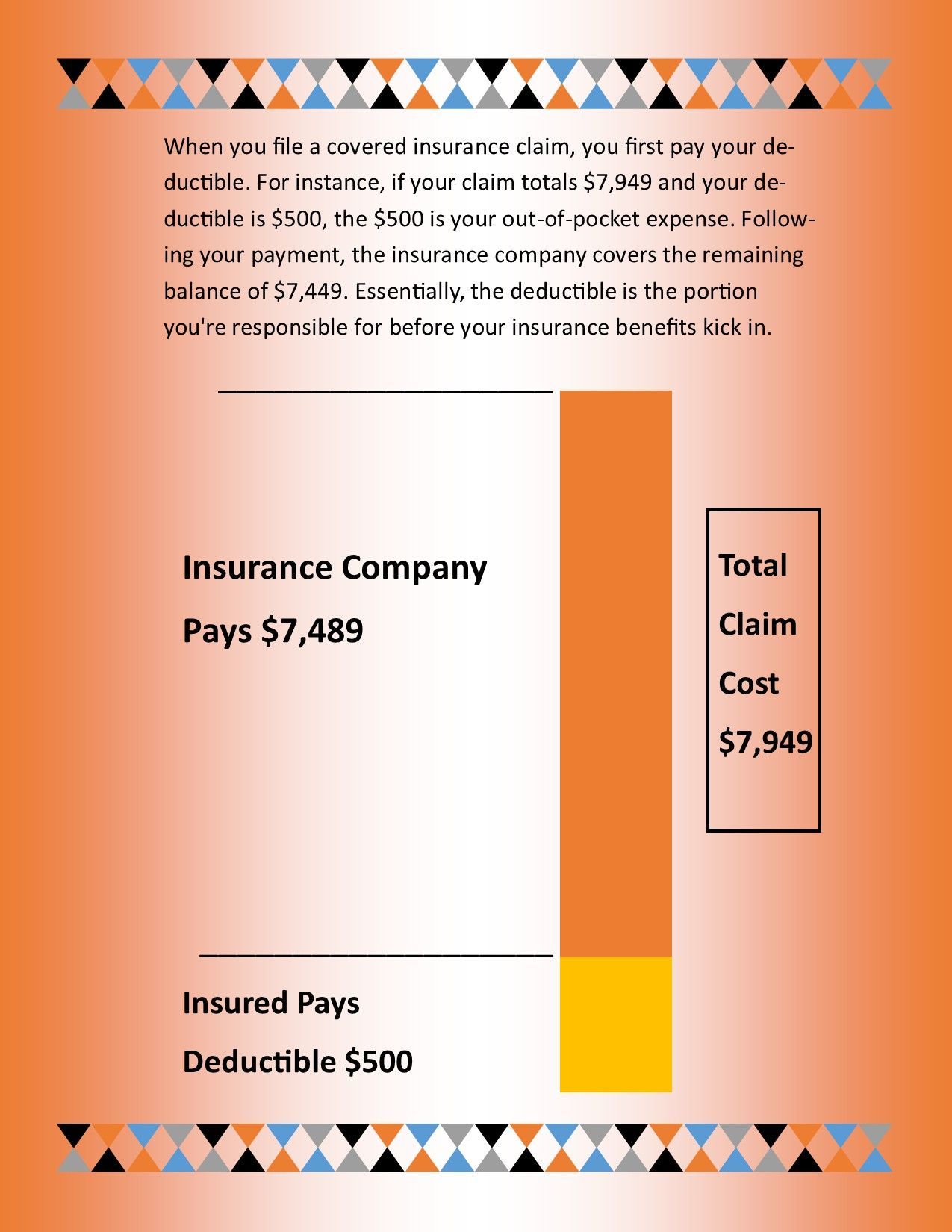

The Deductible: Your Insurance "Starter Fee"

Imagine your car insurance as a generous friend who's always willing to help you out of a jam. But even generous friends have their limits. That's where the deductible comes in. It's the amount you agree to pay out of your own pocket before your insurance company steps in and says, "Don't worry, I got this!"

Deductibles: The "You Pay a Little, They Pay a Lot" Deal

Think of it like this:

Low Deductible:

You pay a smaller amount upfront, and your insurance company covers more of the repair costs. It's like ordering the appetizer sampler; it's a smaller initial hit, but you're still paying.

High Deductible: You pay a larger amount upfront, but your insurance company rewards you with lower monthly premiums. It's like ordering the family-sized pizza; you pay more initially, but you get more bang for your buck in the long run.

Why Do Deductibles Exist?

(And Why They're Not Just Trying to Annoy You):

To Discourage Minor Claims: Insurance companies aren't fans of small claims. It's like calling a plumber to fix a leaky faucet; it's probably cheaper to handle it yourself. Deductibles help keep insurance costs down for everyone.

To Keep You Invested: When you have a deductible, you're more likely to take care of your car and drive safely. It's like having a security deposit on an apartment; you're more likely to keep the place clean.

To Offer Choices: Deductibles allow you to customize your insurance policy to fit your budget and risk tolerance. It's like choosing the spice level on your takeout; you get to decide how much heat you can handle.

How to Choose the Right Deductible (Without Flipping a Coin):

Consider Your Budget: Can you afford to pay a higher deductible if you have a claim? If not, a lower deductible might be a better option. It's like deciding how much you can spend on a night out; know your limits.

Think About Your Driving Habits: If you're a safe driver, a higher deductible might be a good choice. If you're prone to fender-benders, a lower deductible might be safer. It's like deciding whether to wear a helmet while riding a bike; it depends on your risk level.

Don't Forget About Your Car's Value: If your car is older and less valuable, a higher deductible might make sense. If your car is brand new and expensive, a lower deductible might be wiser. It’s like deciding how much insurance you want on your rare collection of porcelain gnomes.

The Moral of the Deductible Story:

Deductibles aren't scary monsters hiding under your car. They're simply a way to balance your insurance costs and risk. And at Select Source Insurance, we're here to help you find the deductible that's just right for you. We'll explain the options, answer your questions, and make sure you understand how it all works. Because let's be honest, nobody wants to deal with insurance surprises, especially when they involve money.

Alright, let's dive into the age-old question that's probably kept you up at night, right after "Did I leave the stove on?" and "What is the deal with airplane food?": Which car insurance company reigns supreme? Now, if you were expecting a definitive answer, a shiny gold medal draped across the metaphorical shoulders of one single insurer, well, grab a lukewarm cup of coffee and settle in. The truth, my friends, is about as straightforward as trying to parallel park on a busy Saturday. The "Best" is a Moving Target. You see, declaring one car insurance company the absolute "best" is like saying there's one single "best" ice cream flavor. Sure, vanilla's a classic, but what about the die-hard chocolate chunk aficionados? Or the adventurous pistachio lovers? Everyone's got their own taste, and the same goes for insurance needs. What's perfect for your neighbor with a squeaky-clean driving record, a sensible sedan, and a garage that's actually used for parking might be a total mismatch for you, the proud owner of a vintage muscle car who occasionally navigates unpaved backroads (and might have a lead foot – no judgment). So, if there's no single "best," what's a responsible driver to do? That's where the magic of an independent insurance agency comes in, and yes, that's us! We're not tied to any single insurance carrier. We're like your personal insurance shoppers, sifting through a variety of options to find the perfect fit for your unique situation. Think of it this way: those big-name insurance companies you see plastered all over TV? They're like department stores. They have a lot of options, but the salespeople are only pushing their own brand. We, on the other hand, are like your local boutique – we handpick from a curated selection of different insurers, focusing on finding the one that truly complements your style (read: driving habits and insurance needs). What We Consider (and What You Should Too): When we're on the hunt for the "best" insurance for you, here are some of the factors we weigh: Coverage Options: Does the policy offer the protection you need? We're talking beyond the basics of liability. What about collision, comprehensive, uninsured/underinsured motorist, or even roadside assistance? Do they have those extra bells and whistles you might want, like accident forgiveness or new car replacement? Price (of course!): While the cheapest isn't always the best, we understand that budget matters. We'll compare quotes from multiple reputable companies to find competitive rates without sacrificing essential coverage. Discounts: Who doesn't love saving money? We'll explore all the potential discounts you might qualify for, from good driver discounts to multi-car or home and auto bundles. Financial Stability: You want an insurance company that will be there when you need them. We look at their financial ratings to ensure they're stable and reliable. Customer Service and Claims Handling: This is where the rubber meets the road (pun intended!). How easy is it to get in touch with them? What's their reputation for handling claims efficiently and fairly? We pay attention to these details because we know how stressful a claim can be. Our "Best" Advice? Talk to Us! Instead of endlessly scrolling through comparison websites and getting lost in a sea of jargon, or filling out some online form that sells our info to 3o different agents, why not let us do the heavy lifting? We'll take the time to understand your individual needs, your driving habits, your vehicle, and your budget. Your information stays private with us. We do not sell your information. You have one point of contact but get rated by many national competing companies. Then, we'll present you with tailored options from a variety of trusted insurance companies. Think of us as your insurance matchmakers. We're here to connect you with the policy that offers the best coverage, the right price, and the peace of mind you deserve. So, is there one single "best" car insurance company? Probably not. But is there a best car insurance company for you? Absolutely. And we're here to help you find it. Give us a call today – let's ditch the guesswork and get you properly protected.

Alright, folks, settle in for a crash course (pun intended!) on the fascinating, slightly bewildering world of car insurance. Yes, I know, it's about as thrilling as watching paint dry, but trust me, understanding how it works can save you from a world of headaches and wallet-emptying woes. Here at Select Source Insurance, we're here to break it down, with a dash of humor to keep you from falling asleep. Car Insurance: It's Not Just a Piece of Paper (Though It Feels Like It Sometimes) Imagine car insurance as a safety net for your four-wheeled friend. When things go sideways (literally or figuratively), it's there to catch you, or at least cushion the financial blow. But how does this magical safety net actually work? The Basics, Explained (With Minimal Jargon): You Pay, They (Hopefully) Pay: You pay a premium (think of it as a monthly subscription to "avoid financial ruin"), and in exchange, your insurance company agrees to cover certain losses if you have an accident, your car gets stolen, or a rogue squirrel decides to use your windshield as a trampoline. Coverage: It's Like a Menu, But Less Delicious: Car insurance policies come with different types of coverage, each designed to protect you in specific situations. Liability Coverage: This is the "oops, I hit someone else" coverage. It pays for their injuries and property damage (up to your policy limits) if you're at fault in an accident. It's like saying, "Sorry about that, let my insurance handle it." Collision Coverage: This covers damage to your own car if you hit something (another car, a tree, a particularly stubborn mailbox). It's like a band-aid for your car's boo-boos. Comprehensive Coverage: This covers damage to your car from things other than collisions, like theft, vandalism, hail, or a herd of stampeding llamas. It's helps with damage other than collisions with limitations. Uninsured/Underinsured Motorist Coverage: This protects you if you're hit by someone who doesn't have insurance or doesn't have enough. It's like having a backup plan for the backup plan. Deductibles: Your Share of the Pie (or Wrecked Bumper): A deductible is the amount you pay out of pocket before your insurance kicks in. It's like a co-pay at the doctor's office, but for your car. The higher your deductible, the lower your premium, but make sure you can actually afford it if you need to file a claim. Claims: The "Please Don't Make Me Cry" Part: When you have an accident, you file a claim with your insurance company. They investigate, assess the damage, and (hopefully) pay for the repairs or replacement. It's like a detective story, but with less dramatic music and more paperwork. Why It's Important to Have a Good Insurance Agent (Like Us!): We Speak Insurance-ese: We can translate the confusing jargon into plain English, so you actually understand what you're paying for. We Shop Around for You: As an independent agency, we work with multiple carriers, so we can find you the best rates and coverage for your needs. We're like your personal insurance shoppers. We're Here When You Need Us: When you have a claim, we'll be there to guide you through the process and make sure you get the help you need. We're like your insurance therapists, but with better advice. We can help you avoid the "I tried to parallel park my boat" situation: Yes, that was a real claim. The Moral of the Story: Car insurance is a necessary evil, but it doesn't have to be a confusing one. At Select Source Insurance in Spartanburg, we're here to make it as painless as possible. So, if you have any questions, don't hesitate to give us a call. We're always happy to help, and we promise to keep the insurance jokes to a minimum (mostly). 864-585-8318 or get a quote at Auto Insurance Quote

Alright, buckle up, buttercups! Let's talk about the thrilling, edge-of-your-seat drama that is... car insurance claims. Yes, I know, riveting stuff. But hey, when you're cruising down the highway, singing along to your favorite questionable 80s power ballad, the last thing you want is a fender-bender followed by a "denied" stamp on your claim. Here at Select Source Insurance, we've seen it all. From the "my dog ate my steering wheel" excuse (surprisingly common, apparently) to the classic "a rogue squirrel ninja attacked my side mirror." So, let’s dive into the burning question: Can your car insurance company actually tell you "no"? Spoiler alert: Yes, they can. And sometimes, they have a point. Think of it like this: your insurance company is less like a benevolent fairy godmother and more like a slightly grumpy accountant who's really good at reading fine print. They're there to help, but they also have rules. And those rules are written in a language that would make a seasoned lawyer weep. While this list below is not all inclusive it does cover some common issues. Reasons Your Claim Might Get the Boot (and how to avoid them): Your policy lapsed: You were too busy watching cat videos to notice: Insurance is like a gym membership; you have to keep paying for it to keep using it. Let it lapse, and you're driving without coverage. That's a big no-no, and your claim will be as rejected as a pineapple on a pizza at an Italian restaurant. You were doing something... "unconventional": If you were using your car as a submarine, a monster truck, or a time machine (and yes, we've heard those stories), your insurance company might raise an eyebrow. Policies are generally designed for normal road use. So, stick to the pavement, folks. You didn't report the accident fast enough: Insurance companies are not fans of suspense. They want to know what happened, and they want to know now. Delaying the report can make them suspicious, and the incident information is still clear in your mind. It’s like waiting three weeks to tell your doctor about a suspicious rash. Not a good idea. You failed to cooperate with the investigation: If your insurance company asks you questions, answer them. If they want photos, provide them. If they want a statement, give them one. Playing hard to get with your insurance company is a surefire way to get your claim denied. In this day of spam calls, many people don't answer unknown numbers, me included. Remember if you have a claim that, unknown number could the claims adjuster. Using your vehicle to make money: You see, your trusty steed of the asphalt jungle, the one you lovingly named "Bessie," has a secret life your insurance company might frown upon. If Bessie moonlights as a delivery vehicle for your artisanal pickle business or ferries clients for your dog-walking empire, well, let's just say your personal auto policy might politely decline to foot the bill after that fender-bender. They tend to get a bit twitchy when they discover you use your personal auto covered by a personal auto policy, and your weekend joyride is actually a weekday workhorse. It's like they envision Bessie sipping champagne on Sundays but sweating it out with spreadsheets and invoices during the week. So, unless you want your claim to be met with the insurance equivalent of a polite yet firm "not on my watch," keep those commercial capers under wraps – or, you know, get the right kind of coverage! So, what's the moral of this story? Read your policy: Yes, it's as exciting as watching paint dry, but it's important. Be honest: Don't try to pull a fast one. Insurance companies have seen it all. Report accidents promptly: Don't wait until your car starts growing moss. Cooperate with the investigation: Be nice and provide the information they need. And most importantly, if you're ever unsure about anything, give us a call at Select Source Insurance. We're here to help you navigate the wild world of car insurance, and we promise to do it with a smile (and maybe a few bad puns). Because at Select Source Insurance, we believe that insurance shouldn't be a headache, it should be a... well, slightly less painful experience.